Roundup: CBOT agricultural futures keep rallying

Xinhua

17 Jan 2021, 00:19 GMT+10

CHICAGO, Jan. 16 (Xinhua) -- Chicago Board of Trade (CBOT) agricultural futures went higher in the past week on bullish U.S. Department of Agriculture (USDA) crop reports, occasionally spotted with declines on profit taking.

Spot CBOT corn scored a 7.5-year high on rising global feedgrain markets. And there's no evidence that U.S. export demand will be slowing through at least the next 3 months. AgResource maintains a total U.S. corn consumption forecast of 15,075 million bushels, 500 million bushels above the USDA forecast. There's a real need for acreage expansion and record yields across the North Hemisphere in 2021 if global supplies are to be partially replenished. The bullish trend will be ongoing into summer.

AgResource pegs the next resistance price for corn at 5.70 to 6.00 U.S. dollars. With an erosion in Brazilian safrinha yield potential amid record low soil moisture and delayed soybean crop development, the world could be stripped of another 8 to 10 million metric tons of feed supplies. A lasting bearish trend requires ideal summer weather across the United States, Europe and Ukraine. The corn demand bull market looks to march even higher into spring.

U.S. wheat futures soared to new rally highs as Russia confirmed it would place a 1.65-dollar-per-bushel tax on its wheat exports beginning March 1. If Russian farmers fail to boost sales in the next 30 days, it would force 3 to 5 million metric tons of wheat demand to North America. Europe does not have the supply which will raise the cost of world wheat. Russian FOB wheat offers soared to over 300 dollars per metric ton late Friday or 8.20 dollars per bushel.

Russia can extend the tax system into 2021-2022 crop year and the general attitude of countries protecting domestic food supplies is bullish non-Russian wheat prices.

Perceived yield loss pushes spot CBOT wheat above 7.50 dollars. Cash sales are on hold as there will be a need to expand global wheat seedings, even in the United States. Rising world corn/feed markets lend additional support.

CBOT soybean futures marked another week of gains and finished above 14 dollars. The January USDA reports were bullish. The USDA cut the yield by 0.5 bushels per acre (BPA), but made surprising increases to both the crush/export forecasts. Some had viewed the December stocks estimate of 175 million bushels as being the pipeline figure that the USDA would not pierce. The January balance sheet estimate showed year-end stocks falling to 140 million bushels.

AgResource predicts the minimum supply of U.S. soybeans at the end of the 2020-2021 crop year being 120 to 140 million bushels.

Share

Share

Tweet

Tweet

Share

Share

Flip

Flip

Email

Email

Watch latest videos

Subscribe and Follow

Get a daily dose of Malaysia Sun news through our daily email, its complimentary and keeps you fully up to date with world and business news as well.

News RELEASES

Publish news of your business, community or sports group, personnel appointments, major event and more by submitting a news release to Malaysia Sun.

More InformationSoutheast Asia

SectionUN Demands End to Myanmar Violence as Junta’s Election Plans Risk Further Instability

Nearly three months after a devastating earthquake struck Myanmar, the country remains trapped in a deepening crisis, compounded by...

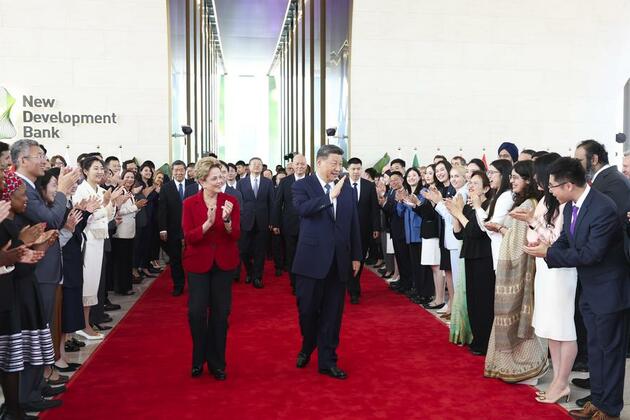

Xi pushes for Global South modernization via practical cooperation

BEIJING, July 4 (Xinhua) -- Ahead of Chinese President Xi Jinping's state visit to Brazil late last year, the Portuguese edition of...

Xi's long-standing commitment to Global South development

BEIJING, July 4 (Xinhua) -- On the banks of the shimmering Huangpu River that cuts through the Chinese metropolis of Shanghai sits...

Russia recognizes Taliban government in Afghanistan

Moscow seeks to build a full-fledged partnership, according to its ambassador in Kabul Moscow has officially recognized the Taliban...

British PM Starmer could be on way out Sky News

The Labour Party is demoralized and in despair just a year after taking power, the outlet has reported UK Prime Minister Keir Starmer...

Bangladesh pursuing extradition of Sheikh Hasina, says Interim govt advisor

Dhaka [Bangladesh], July 4 (ANI): Foreign Affairs Advisor to Bangladesh's Interim Government, Md Towhid Hossain, on Thursday, indicated...

Business

SectionStandard and Poor's 500 and and Nasdaq Composite close at record highs

NEW YORK, New York -U.S. stock markets closed with broad gains on Thursday, led by strong performances in U.S. tech stocks, while European...

Persson family steps up H&M share purchases, sparks buyout talk

LONDON/STOCKHOLM: The Persson family is ramping up its investment in the H&M fashion empire, fueling renewed speculation about a potential...

L'Oreal to buy Color Wow, boosts premium haircare portfolio

PARIS, France: L'Oréal is making a fresh play in the booming premium haircare segment with a new acquisition. The French beauty conglomerate...

Robinhood launches stock tokens for EU investors, adds OpenAI

MENLO PARK, California: Robinhood is giving European investors a new way to tap into America's most prominent tech names — without...

Wall Street diverges, but techs advance Wednesday

NEW YORK, New York - U.S. stocks diverged on Wednesday for the second day in a row. The Standard and Poor's 500 hit a new all-time...

Greenback slides amid tax bill fears, trade deal uncertainty

NEW YORK CITY, New York: The U.S. dollar continues to lose ground, weighed down by growing concerns over Washington's fiscal outlook...