Emerging markets tested by rising dollar ahead of Biden's return

News24

17 Jan 2021, 20:12 GMT+10

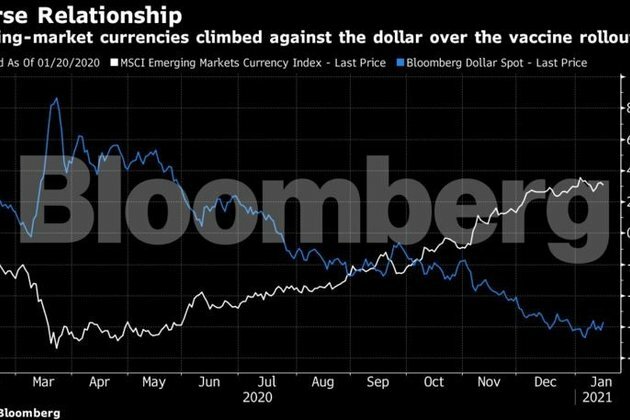

A stronger U.S. dollar is proving to be an early test for emerging-market currencies on the eve of Joe Biden's inauguration.

The greenback gained over the last two weeks, buoyed by the president-elect's proposal for a $1.9 trillion stimulus package. Most developing-nation currencies have slumped in that span, and history suggests further pain may be in store.

MSCI Inc.'s gauge of emerging-market currencies ended 2020 with its biggest quarterly advance in a decade as optimism over the distribution of Covid-19 vaccines bolstered risk appetite. Now, the backdrop of rising cases, renewed lockdowns and vaccine concerns threatens to reverse those flows.

"If vaccines prove less effective than we expect and [the] global economy stumbles, the 'safe haven' dollar would likely appreciate," Goldman Sachs Group Inc. strategists including Zach Pandl wrote in a report.

Still, the strategists "expect broad dollar weakness" this year as exposures to risk assets and upside in commodity prices can outweigh the potential drag from higher U.S. rates.

One currency of interest to investors is the Turkish lira, which has climbed since hitting a record low in November. On Thursday, the central bank is expected to keep the nation's one-week repo rate at 17%.

"The lira has rallied and reserves are stabilizing, providing no reason to raise rates further," according to Bloomberg Economics. "Still, inflation accelerated in December, limiting the scope for rate cuts."

Policy makers in Malaysia, South Africa and Brazil will also decide on their borrowing costs this week.

Meantime, Biden's return to the White House on Wednesday will carry particular significance for traders who follow relations between the world's two largest economies. On Friday, the Trump administration announced it would sanction six officials from China and Hong Kong in a parting shot to Beijing.

Central banks decide

Turkey's central bank will probably leave its benchmark rate unchanged, according to the median estimate of 21 economists surveyed by Bloomberg

- Two economists predict an increase of 50 basis points, while two forecast a hike by a percentage point

- The Monetary Policy Committee led by Governor Naci Agbal boosted the one-week repo rate to 17% from 15% last month, bolstering credibility with investors after he pledged to tighten policy when needed to keep prices in check

South Africa's central bank will probably leave its policy rate on hold at 3.5% on Thursday, according to 15 out of 16 economists in a Bloomberg survey

- One predicted a reduction by 25 basis points

- The second wave of the coronavirus pandemic, renewed lockdown restrictions and the return of power cuts will likely stall a recovery in an economy that contracted 8% in 2020, according to central bank forecasts. Even so, the central bank signaled at its previous policy meeting that it's reluctant to lower borrowing costs further after cutting the repurchase rate five times last year by a total of three percentage points

- Bank Negara Malaysia is expected to keep its benchmark rate on hold Wednesday, according to a median estimate of economists surveyed by Bloomberg

- Bloomberg Economics argues that the central bank can afford to stand pat after 125 basis points of easing last year. Oil prices are also recovering, and Malaysia's key trading partner, China, remains on the mend, it said

- Still, some economists in the Bloomberg survey expect a 25-basis-point cut, in part because of Malaysia's persistently low inflation readings

- Malaysia's December year-over-year CPI is expected to remain deeply negative on Friday

- The rate decision comes after Malaysia's king declared a nationwide state of emergency for the first time in more than half a century, suspending parliament in a move that allows embattled Prime Minister Muhyiddin Yassin to avoid facing an election until the pandemic is over.

- Bank Indonesia is expected to hold policy rates unchanged on Thursday

- The central bank didn't signal that more cuts were imminent at its previous meeting in December, and may be concerned about the risk of higher U.S. yields putting the rupiah under pressure

- One economist in a Bloomberg survey expects a 25 basis-point cut, perhaps because inflation has remained below target for seven months straight

- READ Reflation Flashes Red for Indonesia, Malaysia Debt: SEAsia Rates

- China's one-year loan prime rate -- the reference rate for bank loans to companies -- will likely remain at 3.85% in January, according to Bloomberg Economics

- Brazil's central bank is expected to hold the key rate at an all-time low on Wednesday, while traders look for signs of more hawkish language after policy makers warned that inflation pressures could persist into the new year

- Key Chinese Data

- A slew of economic data from China due Monday will be scrutinized given its importance for the global recovery and the Chinese outperformance narrative. The country reports fourth-quarter GDP and industrial production, retail sales and fixed assets investment data

- Optimism over China's recovery path might be fractionally dented after the poor credit growth numbers last week and disappointing PMIs for December

- December currency settlement data from SAFE are due on Friday. This was previously scheduled for last week. It will be interesting to see if the hitherto low exporter-conversion rates have started to increase, as one would expect given the yuan's steady trend of appreciation in second half 2020

- Ongoing Chinese official resistance to appreciation will also be monitored by traders after higher than expected yuan fixes and reports of state banks buying dollars

- The yuan edged lower last week

More data

- Taiwanese export orders for December are expected to show a further 27% year-over-year increase on Wednesday

- The Taiwan dollar remained little changed last week. The authorities are stepping up their efforts to use moral persuasion to prevent currency appreciation, Reuters reported last week

- South Korea's 20-day January export data are due on Thursday

- These figures will likely highlight continued resilience in external demand at the start of 2021

- The Korean won was the worst-performing currency in emerging Asia last week as higher U.S. yields caused a pull-back in Asia's strongest currency in second half 2020

- That said, a Bloomberg study suggests that the won should be relatively impervious unless the increase in U.S. yields picks up

- The Philippines reports December trade figures on Thursday, while Thailand's December trade numbers will be released on Friday

- South Africa's CPI inflation rate probably fell to 3.1% in December, from 3.2% the previous month, a report may show Wednesday, according to the median forecast in a Bloomberg survey

- On Tuesday, Russia's central bank may publish preliminary 4Q data on the current-account balance, while the federal statistics service releases its consumer confidence index for the same quarter

- The Finance Ministry may report its December budget balance data on Wednesday or Thursday

- Inflation in Poland probably slowed in December to 3.7% from 4.3%, a report may show Monday, according to the median estimate in a Bloomberg survey

- That would give the central bank room to reduce borrowing costs as it tries to weaken the zloty

- A reading of Colombia's November retail sale figures, economic activity index and industrial production on Monday will probably show more signs of recovering activity, while remaining below pre-pandemic levels

- Brazil's economic activity data published on Monday will probably show a small gain in November

- Mexican unemployment data, to be released on Thursday, will be monitored for signs of how high Covid infection rates are impacting jobs

- Inflation for the first half of January, meantime, will probably be relatively stable, according to Bloomberg Economics

Share

Share

Tweet

Tweet

Share

Share

Flip

Flip

Email

Email

Watch latest videos

Subscribe and Follow

Get a daily dose of Malaysia Sun news through our daily email, its complimentary and keeps you fully up to date with world and business news as well.

News RELEASES

Publish news of your business, community or sports group, personnel appointments, major event and more by submitting a news release to Malaysia Sun.

More InformationSoutheast Asia

Section"Why has Mamata not submitted Bangladeshi voters list?": BJP's Amit Malviya targets W Bengal CM over infiltration issue

New Delhi [India], July 13 (ANI): Bharatiya Janata Party (BJP) leader Amit Malviya on Sunday targeted West Bengal Chief Minister Mamata...

Jaishankar set to begin first China visit in five years

By Vishu Adhana Beijing [China], July 13 (ANI) External Affairs Minister S Jaishankar will arrive in Beijing on Sunday evening,...

People from Nepal, Bangladesh and Myanmar found with Aadhaar, domicile, ration cards during SIR in poll-bound Bihar: Sources

Patna (Bihar) [India], July 13 (ANI): A large number of individuals from Nepal, Bangladesh and Myanmar have been found by Booth Level...

Jaishankar meets Singapore's counterpart Vivian Bala, says "Singapore is at heart of India's Act East Policy"

Singapore City [Singapore], July 13 (ANI): External Affairs Minister S Jaishankar held a meeting with his Singapore counterpart Vivian...

MP: Nepal Embassy and PHDCCI India-Nepal Centre organised 'Economic Cooperation Meet' in Bhopal

Bhopal (Madhya Pradesh) [India], July 13 (ANI): In association with the Embassy of Nepal in India, PHDCCI India-Nepal Centre organised...

Pakistan: Islamabad Court suspends ban on five more YouTube channels

Islamabad [Pakistan], July 13 (ANI): Islamabad District and Sessions Court has granted temporary relief to five more content creators,...

Business

SectionFilmmaker joins biotech effort to bring back extinct giant bird

WASHINGTON, D.C.: Filmmaker Peter Jackson's lifelong fascination with the extinct giant New Zealand flightless bird called the moa...

India seeks WTO nod for retaliatory tariffs on US

NEW DELHI, India: India has submitted a revised proposal to the World Trade Organization (WTO) in Geneva to implement retaliatory tariffs...

AI boom propels Nvidia to historic market cap milestone

SAN FRANCISCO, California: Nvidia, the Silicon Valley chipmaker at the heart of the artificial intelligence boom, this week briefly...

AI saves $500 million for Microsoft as layoffs reshape strategy

REDMOND, Washington: Artificial intelligence is transforming Microsoft's bottom line. The company saved over US$500 million last year...

FTC’s rule to ease subscription cancellations struck down by court

WASHINGTON, D.C.: A federal rule designed to make it easier for Americans to cancel subscriptions has been blocked by a U.S. appeals...

Musk’s X loses CEO Linda Yaccarino amid AI backlash, ad woes

BASTROP, Texas: In a surprising turn at Elon Musk's X platform, CEO Linda Yaccarino announced she is stepping down, just months after...