NBFCs loan growth to rise 19% in Q1 FY26 (YoY): Morgan Stanley

ANI

24 Jun 2025, 16:01 GMT+10

New Delhi [India], June 24 (ANI): Loan growth for non-banking financial companies (NBFCs) is expected to remain steady in the first quarter of FY26, rising by 19 per cent compared to the same period last year, and 4 per cent over the previous quarter, according to a recent report by Morgan Stanley.

This pace is similar to the 19 per cent annual growth reported in the fourth quarter of FY25.

The report stated 'On NBFCs, we expect aggregate loan growth to remain stable at +19 per cent YoY, +4 per cent QoQ (+19 per cent in 4Q) in 1QF26'.

The report also expects net profit for these lenders to grow by 15 per cent year-on-year in the June quarter, up from 5 per cent in the March quarter.

The growth is partly due to gains from capital raising activities and a turnaround in profits of a few players who had posted losses in the previous quarter.

Even after adjusting for one-time gains, underlying profit growth is likely to be around 18 per cent year-on-year, higher than 11 per cent growth seen in the previous quarter.

This improvement is largely because the base of the June 2024 quarter was weak due to higher credit costs and lower margins.

In the life insurance space, the report noted that some companies are better placed than others due to stronger growth in annual premium equivalent (APE) in April and May 2025.

The forecast includes around 9 per cent and 6.5 per cent growth in APE in June for the stronger performers.

Meanwhile, another key player would need at least 9.5 per cent APE growth in June just to meet its flat quarterly estimate, following weak trends in the first two months of the quarter.

Growth in value of new business (VNB) is also expected to vary. Some insurers are likely to see double-digit growth, supported by rising demand for non-participating guaranteed products after recent interest rate cuts.

However, others may report flat margins, with outcomes hinging on June performance.

In non-life insurance, the report holds off on giving forecasts due to pending company disclosures and regulatory clarity.

The report added that new business growth for digital insurance distributors is expected to slow for the second straight quarter due to a high base from last year, when the segment grew over 65 per cent in the first quarter.

Meanwhile, capital market-related companies are expected to post strong earnings growth, driven by buoyant market activity.

However, the report warned that valuations in this segment are already high, and recommends a neutral to cautious view. (ANI)

Share

Share

Tweet

Tweet

Share

Share

Flip

Flip

Email

Email

Watch latest videos

Subscribe and Follow

Get a daily dose of Malaysia Sun news through our daily email, its complimentary and keeps you fully up to date with world and business news as well.

News RELEASES

Publish news of your business, community or sports group, personnel appointments, major event and more by submitting a news release to Malaysia Sun.

More InformationSoutheast Asia

SectionLeaked call pushes Thai govt to the brink as allies waver

BANGKOK, Thailand: Thailand's government is facing its biggest crisis in nearly a year, as Prime Minister Paetongtarn Shinawatra's...

Volcanic ash grounds flights to Indonesia, disrupts travel to Bali

LEMBATA, Indonesia: Indonesia's Mount Lewotobi Laki Laki erupted dramatically on June 18, generating substantial ash and smoke plumes....

Investigators examining Black Boxes recovered from Air India Boeing

NEW DELHI, India: Indian investigators are examining the black boxes from a Boeing 787 Dreamliner to determine the cause of a catastrophic...

Nepal Police Search for Journalist Who Reported on Political Family's Business

In Nepal's latest attempt to silence online speech, police are trying to arrest a well-known journalist who published on his YouTube...

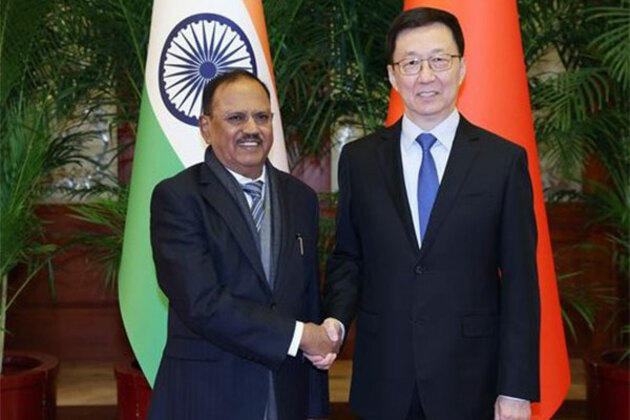

NSA Doval meets China's Vice President Han Zheng in Beijing

Beijing [China], June 24 (ANI): National Security Advisor Ajit Doval on Tuesday met China's Vice-President Han Zheng along with other...

Update: Zou Jiayi elected as next AIIB president

BEIJING, June 24 (Xinhua) -- Zou Jiayi has been elected as the next president of the Asian Infrastructure Investment Bank (AIIB), the...

Business

SectionWater guns become symbol of anti-tourism anger in Barcelona

BARCELONA, Spain: Residents of Barcelona have devised a novel way to protest the presence of tourists in their city. Using a cheap...

Bird flu plan in the works as USDA weighs export, vaccine risks

CHICAGO, Illinois: For the first time in history, U.S. officials are considering a coordinated plan to vaccinate poultry against bird...

U.S. stocks gain ground as investors shrug off Mideast concerns

NEW YORK, New York - U.S. stocks made strong gains on Monday, brushing off concerns Donald Trump's surprise ambush of Iranian nuclear...

U.S. bombs Iran nuclear sites, investors eye oil and safe havens

NEW YORK CITY, New York: The U.S. bombing of Iranian nuclear sites has cast a shadow over global markets, with investors bracing for...

Farmers exploit loophole in Amazon soy deal to clear rainforest

SANTAREM, Brazil: As Brazil cements its position as the world's top soy exporter, a new wave of deforestation is spreading across the...

Europe eases rates as Fed holds and Trump threatens tariffs

ZURICH, Switzerland: A wave of central banks across Europe surprised markets last week by lowering interest rates, responding to easing...