Uncertainty looms for Korean chipmakers in China as US considers ending equipment waivers

ANI

24 Jun 2025, 18:20 GMT+10

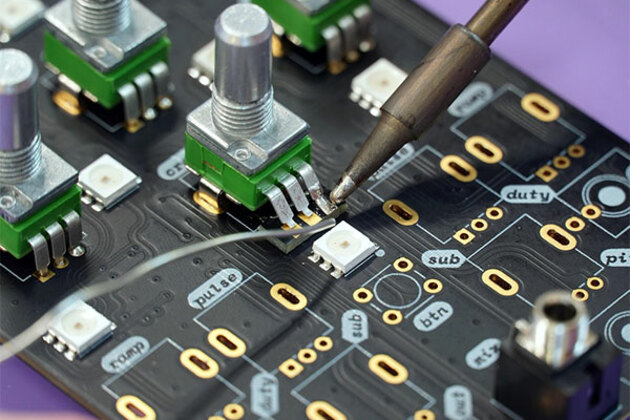

Seoul [South Korea], June 24 (ANI): South Korean chipmakers are experiencing tensions over their operations in China, weighed down by reports from Washington, as they consider revoking waivers that have allowed them to bring in American chip equipment for facility upgrades, as reported by the Korea Herald.

Earlier, the waivers were part of the Biden administration's export controls aimed at restricting China's access to advanced chip technology. However, to prevent disruptions to global supply chains, major chipmakers like Samsung, SK hynix, and TSMC were granted one-year exemptions.

According to a report by The Wall Street Journal, the South Korean companies were informed last week of the U.S. government's intention to cancel these waivers.

This move is reportedly being driven by Jeffrey Kessler, a former U.S. Commerce Department official during the Trump administration, who described it as part of a broader crackdown on critical U.S. technology going to China. White House officials have also indicated that the licensing system for chip equipment could resemble China's controls on rare-earth exports.

While the U.S. has increased efforts to curb China's semiconductor growth, South Korean chipmakers have taken steps to mitigate potential risks, suggesting that the immediate impact might be limited. However, the companies remain cautious as their Chinese fabs contribute significantly to their overall production.

Industry experts told the Korea Herald that the U.S. regulations are primarily aimed at Chinese companies, potentially allowing for exemptions for global firms. They also note that companies have had time to prepare for such restrictions, implying the latest development might not pose a significant immediate threat.

Samsung Electronics has a NAND flash production facility in Xi'an and a chip packaging plant in Suzhou, with China accounting for about a quarter of its chip sales. SK hynix operates a DRAM fab in Wuxi, a packaging facility in Chongqing, and a NAND flash plant in Dalian (acquired from Intel), producing roughly 40% of its total DRAM and 30% of its NAND flash in China. SK hynix recently completed a final payment for the Dalian facility. (ANI)

Share

Share

Tweet

Tweet

Share

Share

Flip

Flip

Email

Email

Watch latest videos

Subscribe and Follow

Get a daily dose of Malaysia Sun news through our daily email, its complimentary and keeps you fully up to date with world and business news as well.

News RELEASES

Publish news of your business, community or sports group, personnel appointments, major event and more by submitting a news release to Malaysia Sun.

More InformationSoutheast Asia

SectionLeaked call pushes Thai govt to the brink as allies waver

BANGKOK, Thailand: Thailand's government is facing its biggest crisis in nearly a year, as Prime Minister Paetongtarn Shinawatra's...

Volcanic ash grounds flights to Indonesia, disrupts travel to Bali

LEMBATA, Indonesia: Indonesia's Mount Lewotobi Laki Laki erupted dramatically on June 18, generating substantial ash and smoke plumes....

Investigators examining Black Boxes recovered from Air India Boeing

NEW DELHI, India: Indian investigators are examining the black boxes from a Boeing 787 Dreamliner to determine the cause of a catastrophic...

Nepal Police Search for Journalist Who Reported on Political Family's Business

In Nepal's latest attempt to silence online speech, police are trying to arrest a well-known journalist who published on his YouTube...

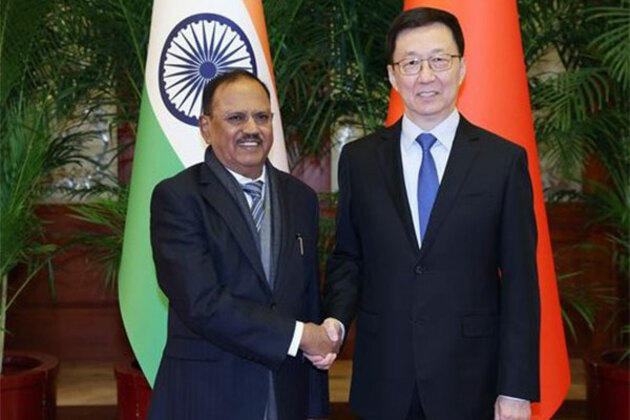

NSA Doval meets China's Vice President Han Zheng in Beijing

Beijing [China], June 24 (ANI): National Security Advisor Ajit Doval on Tuesday met China's Vice-President Han Zheng along with other...

Update: Zou Jiayi elected as next AIIB president

BEIJING, June 24 (Xinhua) -- Zou Jiayi has been elected as the next president of the Asian Infrastructure Investment Bank (AIIB), the...

Business

SectionWater guns become symbol of anti-tourism anger in Barcelona

BARCELONA, Spain: Residents of Barcelona have devised a novel way to protest the presence of tourists in their city. Using a cheap...

Bird flu plan in the works as USDA weighs export, vaccine risks

CHICAGO, Illinois: For the first time in history, U.S. officials are considering a coordinated plan to vaccinate poultry against bird...

U.S. stocks gain ground as investors shrug off Mideast concerns

NEW YORK, New York - U.S. stocks made strong gains on Monday, brushing off concerns Donald Trump's surprise ambush of Iranian nuclear...

U.S. bombs Iran nuclear sites, investors eye oil and safe havens

NEW YORK CITY, New York: The U.S. bombing of Iranian nuclear sites has cast a shadow over global markets, with investors bracing for...

Farmers exploit loophole in Amazon soy deal to clear rainforest

SANTAREM, Brazil: As Brazil cements its position as the world's top soy exporter, a new wave of deforestation is spreading across the...

Europe eases rates as Fed holds and Trump threatens tariffs

ZURICH, Switzerland: A wave of central banks across Europe surprised markets last week by lowering interest rates, responding to easing...